Unlock critical CPI insights for 2025—learn how tariffs and Fed policy could reshape your financial strategy. Dive into the analysis!

Introduction

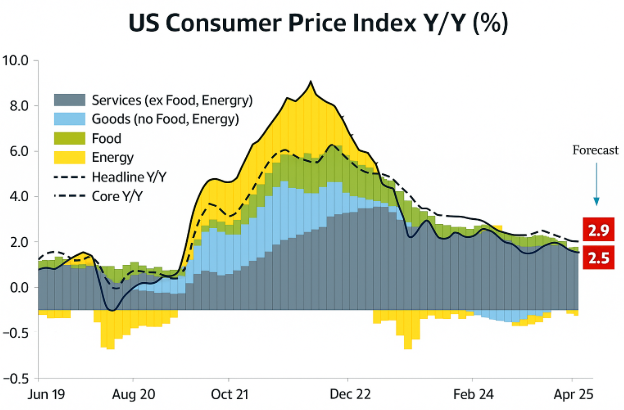

Feeling whiplash from inflation’s rollercoaster? You’re not alone. April 2025 delivered a surprise dip in headline CPI inflation to 2.3%—the lowest since February 2021 . But beneath the surface, core CPI held stubbornly at 2.8%, and economists warn Trump’s tariffs are a ticking time bomb for prices . Let’s dissect what this means for your wallet and portfolio.

Table of Contents

- Headline vs. Core CPI: Why Both Matter

- April’s Data: The Calm Before the Tariff Storm?

- Tariff Impact: When Will Prices Ignite?

- Fed Policy & Rate Cuts: The Waiting Game

- Investor Strategies: Navigating Uncertainty

- FAQs: Inflation Decoded

🎯 Headline vs. Core CPI: Why Both Matter

Headline CPI (2.3% YoY in April) includes all consumer costs—like the 11.8% plunge in gasoline prices that masked other increases . Core CPI (2.8% YoY) strips out food and energy, exposing structural pressures—think medical care (+0.2% MoM) and shelter (+0.3% MoM) . The gap between them? A red flag for sustained inflation.

⚖️ April’s Data: The Calm Before the Tariff Storm?

April’s mild 0.2% monthly CPI rise felt like a victory lap:

- Falling prices: Apparel (-0.2%), used cars (-0.5%), and airfares (-2.8%) offset energy gains .

- Grocery relief: Egg prices cratered 13% monthly—the steepest drop since 1984 .

But don’t celebrate yet. As Moody’s Mark Zandi warned: “Soak this report in. It’ll be a while before we get another good one” .

Table: Key CPI Components in April 2025

| Category | Monthly Change | Annual Change |

|---|---|---|

| Headline CPI | +0.2% | +2.3% |

| Core CPI | +0.2% | +2.8% |

| Gasoline | -0.1% | -11.8% |

| Shelter Costs | +0.3% | +4.0% |

| Apparel | -0.2% | -1.1% |

| *Source: Bureau of Labor Statistics * |

💣 Tariff Impact: When Will Prices Ignite?

Trump’s tariffs—10% on most imports and 30% on China—are a slow-burning fuse. April showed glimmers (audio equipment +9%, photo gear +2.2%), but broad impacts were muted . Why? Timing lags. As J.P. Morgan’s Vinny Amaru noted:

“May’s data will likely be a more helpful read on the pass-through from tariffs to consumer prices” .

Economists project core CPI could hit 3.5% by late 2025 if tariffs hold—adding $2,800/year to household costs .

🏛️ Fed Policy & Rate Cuts: The Waiting Game

With inflation near its 2% target, the Fed faces a dilemma: cut rates to support growth or wait out tariff chaos. Markets see near-zero chance of a June cut, with July odds at just 15% . The Fed’s message? “Uncertainty about the economic outlook has increased” . Translation: Rate cuts won’t land before September .

💼 Investor Strategies: Navigating Uncertainty

1. Equities focus: Target tech (high earnings growth) and international markets like Japan/Europe (fiscal stimulus) .

2. Hedge with gold: A buffer against tariff-driven inflation spikes .

3. Lock in sales: Apparel and electronics discounts won’t last once tariffs bite .

As Lazard’s Ronald Temple warns: “Core inflation could hit 4%”—diversify now .

❓ FAQ: Inflation Decoded

Q1: How does core CPI differ from headline CPI?

A: Headline CPI includes volatile food/energy costs—like gas prices—while core CPI excludes them to reveal underlying trends. April’s 0.5% gap signaled persistent inflation pressure .

Q2: When will Trump’s tariffs push CPI higher?

A: Economists expect visible impacts by June–July 2025, with full effects peaking in Q4. May’s data is a critical “test” for early signs .

Q3: Could the Fed cut rates if tariffs spike inflation?

A: Unlikely. The Fed views tariff-driven inflation as temporary. Rate cuts require sustained disinflation—now delayed until at least September .

Conclusion

So, what’s the real takeaway from April’s CPI report? Don’t get too comfortable. Sure, the dip in headline inflation feels like a win—gas prices down, eggs finally affordable again—but the stubborn core CPI and those looming tariffs? They’re the financial equivalent of a “check engine” light. Ignore them at your own risk.

If you’re an investor, stay sharp. If you’re a budget-conscious shopper, enjoy the discounts while they last. And if you’re just trying to make sense of it all? Bookmark this piece. Because when the next inflation wave hits (and it will), you’ll want to be ready.

Got thoughts? Drop a comment below—or share this with someone who’s sweating over their 401(k). 💸

P.S. For the latest CPI updates, the BLS CPI Calculator is your best friend.